Here’s my annual list of Top Health IT Predictions, many of which are being driven by the continued shift to value-based care (VBC) and the many other areas it drives,includingimproved payer-provider coordination, price transparency, the high cost and use of specialty medications andinteroperability standards.

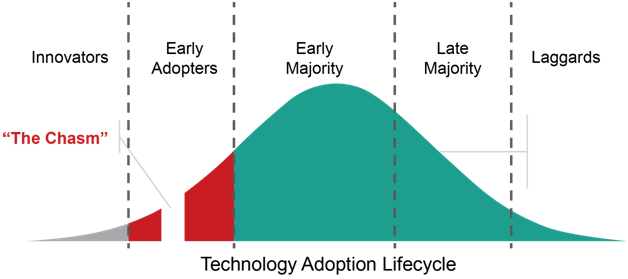

1. Innovators and early adopters of VBCwill cross the chasm.In 2018, I heard former Secretary of Health and Human Services and Governor of Utah Michael Leavitt say that we are 25 years into a 40-year transition to value-based care. His observation resonated with mebecause, well, it takes time to fundamentally change the way healthcare is reimbursed, and people too often get discouraged at the pace of change in health care. I thought it put things in perspective.

2020 will be the year innovators and early adopters begin implementing technology that supports VBC. Some will cross the chasm; some won’t. Some have a culture of doing it themselves while others will get help from experts who have been involved in the development of use cases and standards and have experience implementing technology. Regardless of expert help or not, it’ll take time to transform the health information technology (health IT) ecosphere because many stakeholders are using 1980-90s technology.

Source: "The Chasm" (Moore, 1991)

Source: "The Chasm" (Moore, 1991)

Without a doubt, there will be expanded use of the Health Level 7 (HL7) Fast Healthcare Interoperability Resource (FHIR) standard. We expect payers, providers and other stakeholders involved in the DaVinci Project to start using it. But it will be the innovators and early adopters who work out any issues with the standard and measure return on investment. Transactions among innovators and early adopters, however, will only get us so far, so scaling FHIR will be imperative. Technical architectural barriersand possible solutions to scaling FHIR have been identified by the FHIR at Scale Taskforce, convened by the Office of the National Coordinator for Healthcare Information Technology (ONC).

2. Electronic prior authorization (ePA) will mature and expand to include drugs and devices covered under the medical benefit. 2020 will be a busy year for ePA, as many stakeholders push to make it the norm rather than the exception in order to address providers’ challenges and concerns related to administrative burden and delayed timetotherapy.A major shift we’ll see in 2020 will be from ePA 1.0 to ePA 2.0, meaning that the focus to automate will expand to include not only drugs covered under a patient’s pharmacy benefit but also drugs and devices covered under a patient’s medical benefit. Use cases are being developed and balloted, such as the prior authorization support use casespearheaded bythe Health Level Seven (HL7)DaVinciproject.

Also in 2020, we will see a shift from payers denying payment to more guiding of care. Recognizing that prior authorization (PA) restrictions are often unrealistic and burdensome/expensive for everyone involved, an increasing number of payers will wrestle with the need for PAand may choose new approaches such as implementing Da Vinci uses cases designed to reduce, inform and delegate prior authorization support and exploring possible uses of artificial intelligence.

In addition, America’s Health Insurance Plans (AHIP), a major insurance industry group, and several member insurers (covering 60 million lives) also launched a pilot to evaluate different approaches to ePA.During the recent ONC annual meeting, Kate Berry, AHIP senior vice president for clinical affairs and strategic partnerships, made it clear that payers will be working hard on ePA in 2020 saying, "Believe it or not, plans don't like prior authorization either; we know there are lots of opportunities for improvement."

Part of this shift will go beyond automating PA and alsoinclude payers beingmore transparent with physicians about which drugs or devices require PA and suggestingevidence-based alternatives that don’t. With myriad approaches to streamlining PA and increasing adoptionof ePA, there are sure to be challenges in determining the approach and implementation plan that will work best within a particular organization.

3. The intricacies of price transparency will begin to unravel, revealing opportunities.The federal government will be implementing its vision and use every lever at its disposal – including rulemaking – to makehealthcare function more like a normal market where publicly available pricing information empowers patients to shop competitively for care, increasing competition among hospitals and insurers.

2020 will see progress in efforts to chip away at the complexities of price transparency, including list price vs negotiated prices vs patient out-of-pocket costs. For example, the Transparency in Coverage proposed rule would (if finalized) require insurers and health plans to provide beneficiaries real-time, personalized access to cost-sharing information. Similarly, a separate final rule would require 6,002 hospitals to publish payer-specific negotiated prices for items and services beginning on January 1, 2021.

To be sure, immediate benefits won’t be seen from these recent price transparency rules but should be a catalyst for stakeholders to explore how they can transform something they must do into something that differentiates them in the market.

Rather than doing the bare minimum, smart stakeholderswill be thoughtful about what information is most helpfulto patients and ways to provide that information in the most user-friendly way. They will also see opportunity in augmenting their price transparence tools with effective patient education and outreach to meet patients where they are, bring them up to speed and equip them to make more informed decisions based on not only price but value.

A lot of work has been done around prescription price transparencyand that will continue to be refined in 2020. Price transparency tools, such as the consumer-facing, real-time pharmacy benefit check standard being developed by the CARIN Alliance,will be rolled out along with other real-time pharmacy benefit tools which will help patients, their doctors and other stakeholders make better decisions on prescriptions. Under a new final rule, Medicare Part D plans must adopt one or more real-time benefit toolsby January 1, 2021. They will inform prescribers when lower-cost alternative therapies are available under the beneficiary’s prescription drug benefit, which can improve medication adherence, lower prescription drug costs, and minimize beneficiary out-of-pocket costs.

But payers and providers now have an opportunity to use price transparency to increase competitive advantage and to better support value-based care.

4.Automated specialty enrollment will begin the process of streamlining the specialty prescription process.2020 will see continued action and opportunity around specialty pharmacy automation. Use of specialty medication is accelerating,with these drugs accounting for half of the drug spend and continuing to grow. Yet specialty pharmacy is still largely unautomated. An automated means for specialty enrollment will be a primary goal for bringing specialty pharmacy into the 21st century. This should ease the enrollment burden surrounding the crucial first step involved with obtaining a specialty medication. Standards work will continue to be the backbone of progress, with a new specialty standard likely to be voted on within the National Council for Prescription Drug Programs this year.

5. FHIR adoption will accelerate as will key work addressing infrastructural barriers. Use of the FHIR standard will continue to pick up momentum, bringing healthcare data exchange to a more modern level. Drivers to accelerate adoption include efforts by several initiatives likeDa Vinci, Sequoia, Argonaut andFAST, as well as government policies, principally from ONC. Expect new use cases and pilots to improve the use of FHIR as a mechanism to get information both into and out of EHRs, especially as it relates to taking advantage of the anticipated finalization of information blocking rules. At the same time, the industry will move to identify infrastructure gaps to support those use casesand toward standardized, FHIR-based transactions to address those needs rather than push most requirements back on providers. Clearly, FHIR has been tapped by industry leaders and government agencies as a key tool to improve data exchange and interoperability. Organizations that haven’t yet hopped on the FHIR train may need some help to catch up.

6. Trusted Exchange Framework and Common Agreement (TEFCA) publication will establish a “single on-ramp).Many see thefuture of national-scale health data exchange as being based on the long-awaited and yet-to-be published final rule being developed for the Trusted Exchange Framework and Common Agreement (TEFCA). Its goal is to provide a standardized, secure and scalable data exchange framework that will serve as a “single on-ramp.” This will create opportunities for some, but shouldn’t change the landscape all that much, as information exchange is more a function of business’ willingness to share information than technology.

7. EHR-companies finally know how information-blocking rules will impact them.Now that the final information blocking rules have dropped, many stakeholders have begun to analyze their impacts. EHRs are at the head of that list – and have a relatively short compliance window.

2020 to be a busy year for Health IT.

Edited by

Maurice Nagle